What to Do When Money Worries Never Switch Off

In today’s fast-paced world, financial stress is a common concern that affects millions of individuals and families. Whether it’s due to rising living costs, unexpected expenses, or stagnant wages, the feeling of being overwhelmed by money worries can be debilitating. Understanding how to manage your finances and mental health when these worries persist can make all the difference.

Understanding the Root Causes of Money Worries

Before you can effectively address your financial concerns, it’s essential to understand what causes them. Here are some prevalent issues:

- Unemployment or Underemployment: Job loss or a lack of sufficient employment can create significant stress. According to the South African Government, the unemployment rate was around 34% in 2021, exacerbating financial anxiety for many citizens.

- Debt Accumulation: Credit card debt, student loans, and personal loans can contribute to financial strain. The National Credit Regulator (NCR) reported that many South Africans are over-indebted, making it difficult to manage monthly expenses.

- Unexpected Expenses: Sudden medical bills, vehicle repairs, or home emergencies can create immediate financial pressure.

- Limited Financial Literacy: A lack of understanding regarding personal finance can lead individuals to make poor financial decisions, compounding their worries.

Recognizing the Signs of Financial Stress

Financial stress can manifest in various ways. Recognizing these signs is the first step towards effective management:

- Anxiety or Depression: Persistent financial worries often lead to mental health issues, including anxiety and depression.

- Physical Symptoms: Stress can cause physical symptoms like headaches, fatigue, and digestive issues.

- Relationship Strain: Money worries can strain relationships, leading to conflicts between partners or family members.

- Inability to Focus: Constantly thinking about financial problems can hinder your ability to concentrate at work or enjoy personal activities.

Practical Steps to Alleviate Money Worries

While it may feel like your financial worries will never switch off, there are practical strategies you can adopt to regain control:

Create a Comprehensive Budget

One of the most effective tools for managing money worries is a well-structured budget. Start by tracking your income and expenses for a month. This will help you to identify where your money is going and where you can cut back. Use budgeting apps like Mint or You Need a Budget (YNAB) to simplify the process.

Build an Emergency Fund

An emergency fund can provide a financial cushion that alleviates the pressure of unexpected expenses. Aim to save at least three to six months’ worth of living expenses. Start small; even saving R500 a month can add up over time.

Seek Professional Financial Advice

If your financial situation feels overwhelming, it might be time to consult a financial advisor. They can help you create a tailored financial plan based on your unique circumstances. Organizations like the National Credit Regulator offer resources and advice for individuals struggling with debt.

Addressing Debt Wisely

Debt can be a significant source of money worries. Implement the following strategies to manage it effectively:

- Debt Snowball Method: Focus on paying off your smallest debts first, which can provide a psychological boost.

- Negotiate with Creditors: Contact your creditors to discuss payment plans or settlements. Many are willing to work with you during tough times.

- Consider Debt Counseling: Debt counseling services can provide you with a structured plan to manage your debts more effectively.

Practice Mindfulness and Stress Management

Financial anxiety can be overwhelming, but practicing mindfulness and stress management techniques can help you cope:

- Meditation: Spend a few minutes each day meditating. Apps like Headspace can guide you through this process.

- Physical Activity: Regular exercise can reduce stress levels and improve your mood.

- Talk About It: Sharing your concerns with a trusted friend or family member can provide emotional relief and sometimes lead to practical solutions.

Enhance Your Financial Literacy

Improving your understanding of financial concepts can empower you to make better decisions. Consider the following resources:

- Investopedia: Offers articles, guides, and tutorials on a wide range of financial topics.

- Khan Academy: Provides free courses on personal finance, investing, and more.

- Consumer Financial Protection Bureau: A government agency that provides resources and information about managing money.

Real-World Examples of Overcoming Financial Stress

Many have faced significant financial challenges and emerged successfully. For example, South African entrepreneur Vusi Thembekwayo grew up in a township and faced numerous financial struggles. However, through determination, education, and a focus on financial literacy, he has become a successful business leader and motivational speaker. His story serves as an inspiration for those grappling with money worries.

FAQs About Money Worries

1. How can I reduce my financial anxiety?

Start by creating a budget, building an emergency fund, and seeking professional financial advice. Additionally, practicing mindfulness and stress management techniques can help alleviate anxiety.

2. What should I do if I can’t pay my bills?

Contact your creditors to explain your situation. Many are willing to work with you to create a manageable payment plan. Consider seeking assistance from a financial counselor if needed.

3. Is it possible to recover from financial hardship?

Yes, many people have successfully navigated financial difficulties by implementing effective budgeting, seeking support, and improving their financial literacy.

4. Where can I find financial education resources?

Websites like Investopedia, Khan Academy, and the Consumer Financial Protection Bureau offer valuable information and resources.

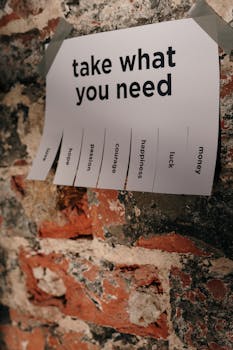

Taking Control of Your Financial Future

When money worries seem relentless, it’s crucial to take proactive steps to regain control. By understanding the root causes of your financial stress, implementing practical strategies, and seeking support when necessary, you can pave the way for a more stable and secure financial future. Remember, you are not alone in this journey, and with the right resources and mindset, you can overcome these challenges.